What is the Value of a Network?

A single fax machine is useless, but the value of every fax machine increases with the total number of fax machines in the network. — Ancient Tech Proverb

In 1984, AT&T was broken up. In a congressional hearing, as the story goes, Bob Metcalfe, an early pioneer of the internet and MIT engineer, spoke up and said that AT&T’s network itself was its most valuable part. In fact, he had been preaching this for a long time as the internet adopted his Ethernet standard. When selling hard drives to customers, he told them, if you invest in your network size linearly, its value will grow exponentially. From there, a famous technology axiom, rivaling Moore’s Law was born.

The value of a telecommunications network is proportional to the square of the number of connected users of the system.

For the mathematically inclined: value = n^2, where n is the number of connected users. This concept stems from the fact that as the number of participants (n) grows, there are exponentially more unique connections between individuals, as seen in the illustration below.

Modern Day Examples and Applications

Metcalfe’s law is a way to quantify “network effects,” which can be applied to everything from highways to fax machines to phones. Nowadays, these effects are at the heart of technology investing. Communication devices like mobile phones become more valuable to an individual user as more users join and connect. Uber needs both riders and drivers, more of each creating a vaster network of rides; Apple sold its first billion phones in ten years, then the next billion in only two years; Amazon has seen dramatic drops in value over the years.

Metcalfe’s Law proves that network values do in fact grow in value exponentially. Take FAANG stock prices, for example.

That FAANG chart doesn’t look too dissimilar to bitcoin’s chart over the last ten years, including the volatility.

Or the total value locked in DeFi protocols over just the last few years.

Now, understanding exponential growth is no easy feat for the human brain. It’s difficult to forecast the future at all, let alone forecast with exponential growth. It’s outside the scope of this write-up, but for a clear and entertaining explanation of exponential growth, see the “rice and chessboard” story in Resources below.

Crypto Network Effects

Cryptocurrencies transfer value. They are payment networks with users. As more people use the technology, more will join to be able to transact with those already using it, just like the internet. This value transfer in action? Think: why did you first download Venmo? Likely, to accept money from someone who had the app.

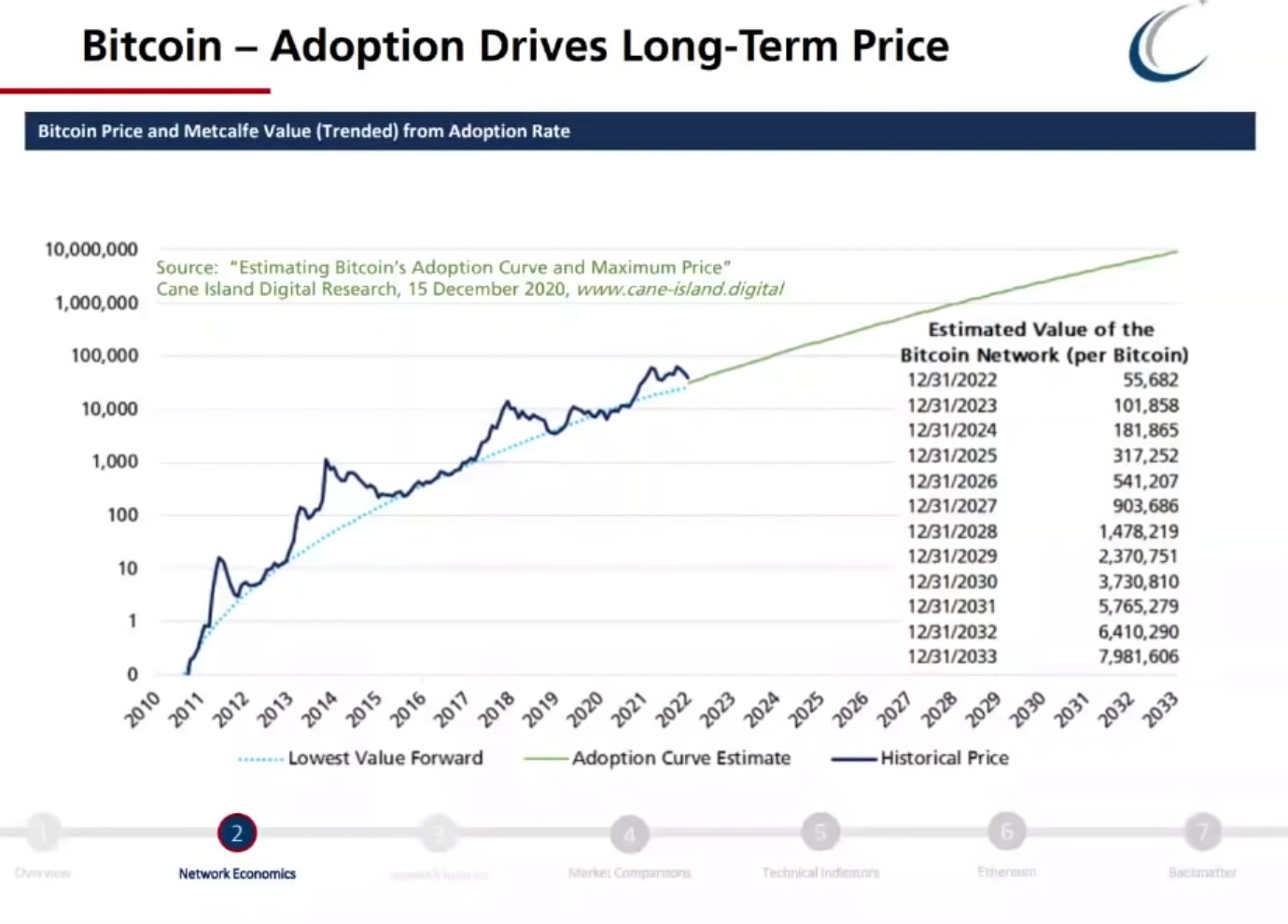

Metcalfe’s Law has been used repeatedly to estimate bitcoin’s fair value based on its network, one example is seen below from Cane Island Digital Research.

As the number of active addresses on these digital asset networks grows, the value, according to Metcalfe’s Law, grows exponentially. And other digital asset networks seem to follow this trend pretty closely.

An important distinction: network effects are not the same as viral growth. Network effects add value because as more users engage the lifetime value for a user rises: as more friends joined Facebook in the early days, people spent increasing time on Facebook. On the other hand, viral growth is about adoption speed. The lifetime value to a user doesn’t increase with adoption, just like I don’t benefit from more people playing Wordle every day.

As with any methodology, Metcalfe’s Law has its limitations.

It applies to interconnected networks. Justin Bieber is not worth the square of his 220M Instagram followers. (However, he’s not doing too badly).

The law is based on potential contacts. This examines the technology side of a network. The social, regulatory, and other aspects of a network are not taken into account. Reed’s Law builds on Metcalfe’s Law to provide a measure of the scale of group-forming networks as they grow.

As we progress on this crypto adoption journey, it’s key to keep these ideas renewed and refreshed when thinking about the value of this emerging technology.

Closing Thoughts

Robert Metcalfe saw the implications of technology to create his famous law. We can apply Metcalfe’s Law to cryptocurrencies and the exponential age of technology to see through near-term volatility and understand the potential implications of exponential network growth.

Some key stats:

The cryptocurrency with the most daily active users is Tron, followed by bitcoin, then ethereum.

The valuation of bitcoin according to Metcalfe’s Law is $970B, compared to its current market cap of $850B.

Resources:

Tim Ferris interview with Robert Metcalfe

Metcalfe’s law applied to NFTs

The power of exponential growth: the rice and chessboard story.

The Exponential Age: Watch a full-length webinar of Mark Yusko of Morgan Creek Capital talk about exponential growth.

Cover image source.

➡️ About FirstWatch Crypto ⬅️

FirstWatch Crypto was started by Dan McGlinn (@DigitalDanMcG) and John "Blaize" Hrabrick (@blaizebitcoin) who have been investing in the space for a combined 8 years. FirstWatch Crypto is on a mission to simplify the crypto investment landscape.