Volatility

Let’s talk volatility. It’s impossible for most to think of cryptocurrencies without considering the dramatic swings both up and down.

Take bitcoin for example. In October 2021, bitcoin turned 13 years old.

“Like other teenagers, Bitcoin hit something of a growth spurt: It acquired new friends, started new hobbies, and in some places even became legal. But that doesn’t mean it has come of age.” (Bloomberg.)

Perhaps the most fundamental reason for the volatility of crypto and emerging technology is their youth. It’s currently in what can be called price discovery phase: the market is determining the proper price of an asset. This phase factors in overall supply, the macroeconomic environment, investor risk attitudes, media sentiment, leverage, and regulation, among others. In markets, investors and speculators need to find their feet as the terminal value is defined. This is what will push the market to mature and eventually stabilize. For now, negative news cycles and other factors will impact sentiment.

With bitcoin and all digital assets, the adoption hinges on the pace of technological adoption. Using crypto is far more user-friendly now than it was 10 years ago, but will continue to become easier to use for the early and late majorities, as is typical of innovation adoption cycles shown below.

Amazon.Bomb

Amazon’s IPO occurred on May 15th, 1997. At the time, Bezos spoke about it as the greatest model for retail. It also lost money for 10 years straight. We’re not here to tell you how much a $1,000 investment would be worth today, because we don’t want you to cry (and only the Bezos’ have managed an investment that long.)

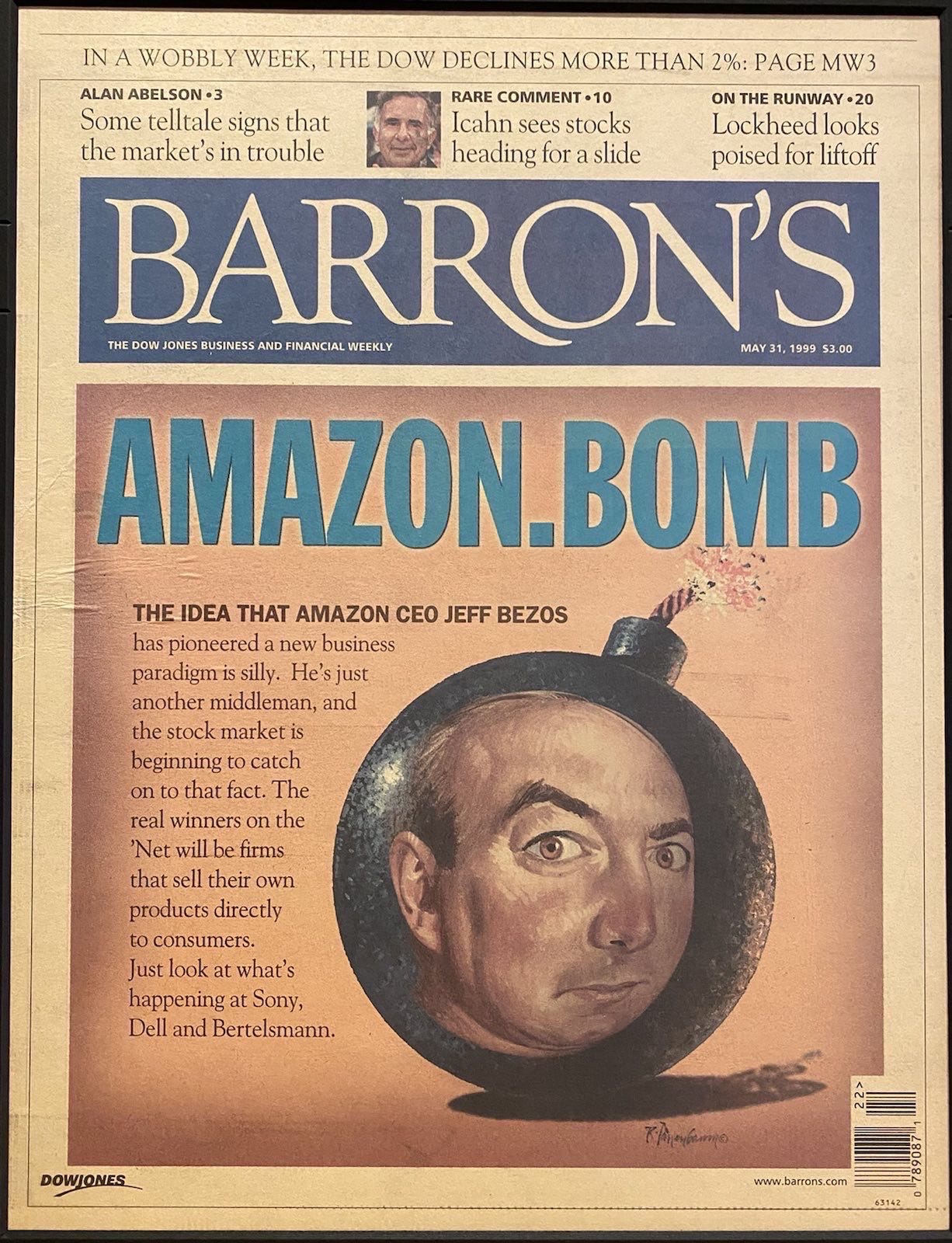

The Barron’s Amazon.Bomb cover in 1999 announced the death of Amazon — just like the timeline of bitcoin obituaries dating back to 2010.

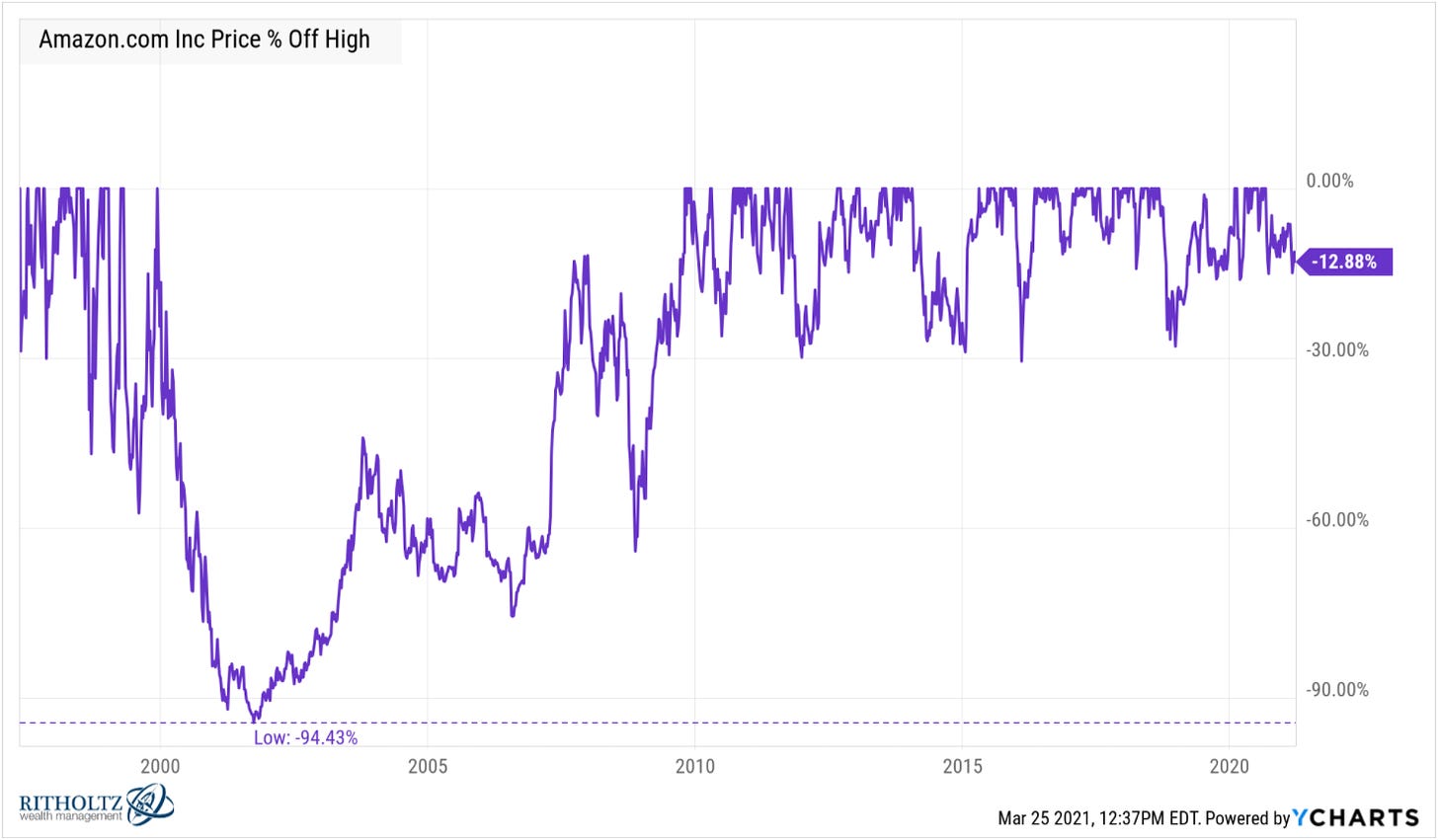

Despite its success, since the IPO Amazon has dropped by 30% eight times, by 50% two times, and by a whopping 90+% one time. Every year, there has been a double digit drawdown average peak to trough. The drawdown chart below makes this clear. Being such a rocky ride made it easy to overthink the investment. If the 94% drop in 1999 didn’t have you shaking, maybe the 58% drop in 2008 did.

Bitcoin, viewed as a barometer for the digital asset market, has had a tumultuous past not unlike Bezos’s Amazon. Mass adoption and price discovery is marked by historic drops and volatility. It takes time for thought-shifting paradigm shifts to play out. But Amazon has made 2-day delivery an expectation.

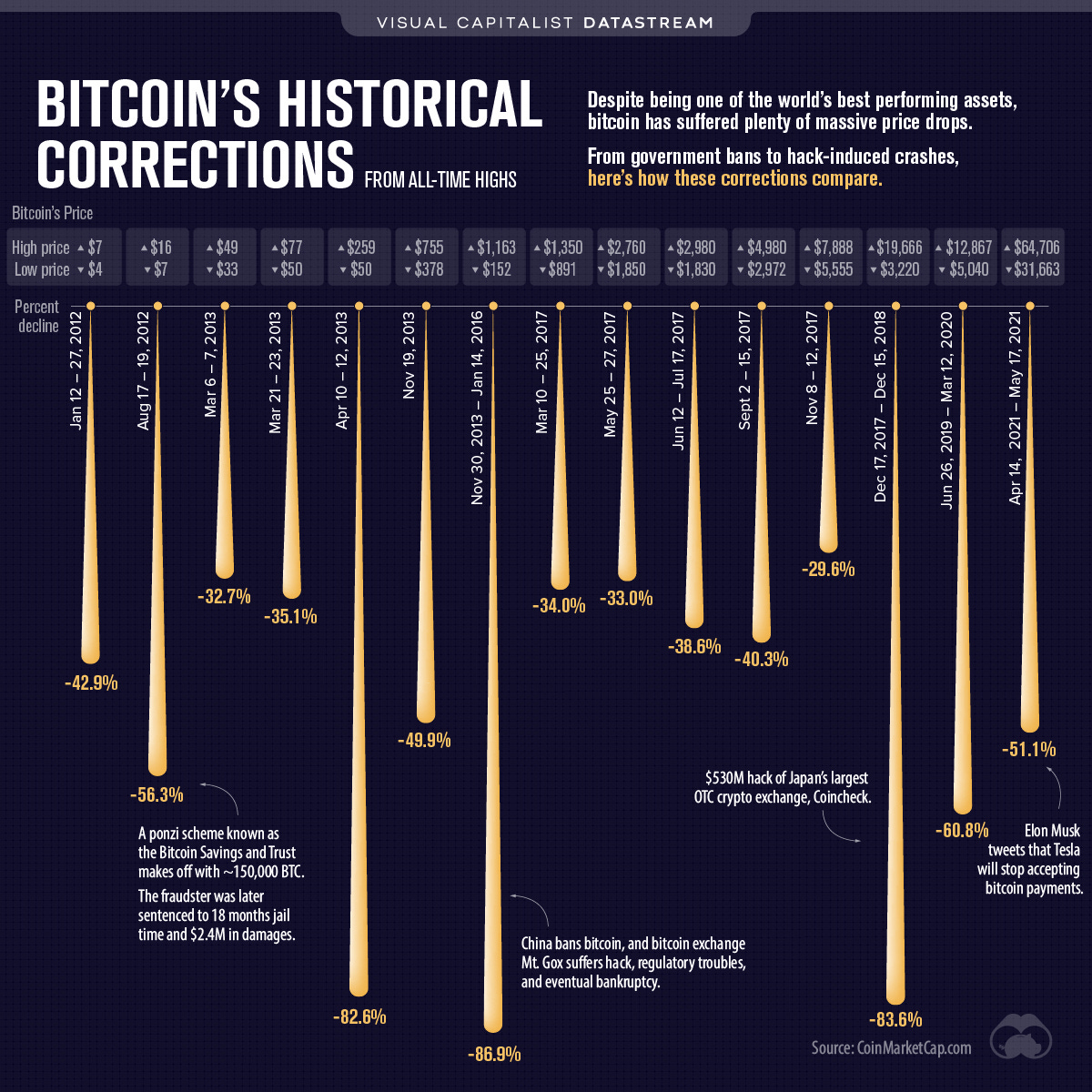

We wrote about Bitcoin crashes during the 51% crash back in May 2021. Scott Melker of the Wolf of All Streets podcast has said, “While a 50%+ drawdown seems significant in most markets, seasoned crypto investors call is ‘Tuesday.’ People have a short memory, and seem to forget that bitcoin dropped from $60,000 to $30,000 in 10 days last May.”

Here are other dramatic bitcoin price drawdowns.

Why do people miss these opportunities? Among the reasons: these two investments were a cultural shift from the norm. They represented a fundamental change in the way traditional stakeholders thought about value. These opportunities require research, but can prove to be the big winners in the long term. The daily price of digital assets doesn’t matter. It’s been alive for ten years, in every year except for one, it’s made a higher low. Every fundamental indicator continues to make new highs.

Looking Ahead

While price discovery of bitcoin and digital assets continues, we can expect further volatility. But bitcoin, at least, has proven resilient.

“Like Tyson Fury, bitcoin takes some enormous hits, but repeatedly seems to fight back with a resurgence that stuns its detractors.

The fact that it has done this so often in a short space of time is at least initial evidence that Bitcoin’s volatility is less bubble behavior, and more the price discovery mechanism of a genuinely new asset class.” — Man Solutions’ Members, part of the Man Group

Some key stats:

As of 2021, about 106 million people around the world use cryptocurrencies. (1.2%)

About 46 million Americans (roughly 22% of the adult population) own a share of Bitcoin.

For those still wondering, a $1,000 investment in the Amazon IPO would be worth $2.3M today.

Resources:

For some serious price speculation: Ark Invest expects bitcoin to exceed $1 million by 2030.

Analysis on how much more loss Bitcoin can sustain.

➡️ About FirstWatch Crypto ⬅️

FirstWatch Crypto was started by Dan McGlinn (@DigitalDanMcG) and John "Blaize" Hrabrick (@blaizebitcoin) who have been investing in the space for a combined 8 years. FirstWatch Crypto is on a mission to simplify the crypto investment landscape.