Market Update: Q3 2021

The rise of institutional capital has kept Bitcoin floating in the $40k-$50k range, looks to break out.

Lots of Headlines this Quarter from all Corners of Crypto

This quarter has seen further institutional adoption, regulatory discussion, and protocol development than what we've seen in quarters past. While far from comprehensive, the below news blurbs will get you up to speed on recent developments as we head into the final quarter of 2021.

Global News

El Salvador officially adopted Bitcoin as legal tender on September 7th, marking the first nation to do so. They provided citizens with a wallet that is preloaded with $30 of Bitcoin. President Nayib Bukele and the El Salvadorian government have purchased 700 Bitcoin ($37 million) since adoption. While the roll-out has had its bumps, there are now more people with a Bitcoin wallet than a bank account in the small nation.

In more global news, China banned Bitcoin (for the 5th time). All financial activities linked to cryptocurrencies are deemed illegal in China. The announcement saw a shift onto decentralized exchanges.

Regulatory News

More regulatory news came from the U.S. Congress when they worked to establish tax rules around the digital asset industry. Senators proposed taxing all aspects of cryptocurrencies that fall under the broad term "broker." The biggest takeaway was the global, vocal support. Hundreds of thousands of calls were made to state representatives, and prominent voices like Elon Musk spoke out against the strict and hasty legislation.

FirstWatch Crypto attended the Digital Asset Summit in New York City, where many speakers speculated about industry regulation. There has been continued regulatory scrutiny from Federal Reserve Chair Jerome Powell. Many believe regulation would be a net positive for the sector, building guide-rails to promote future innovation. Crypto billionaire Wu Jihan told CNBC that recent regulatory pressure is “very healthy” for the industry.

Financial News

MasterCard has partnered with USDC to allow merchants to offer card services to cryptocurrency holders by performing transactions using stablecoins. JPMorgan has pivoted its stance and backed a 1% Bitcoin portfolio allocation for its retail wealth clients.

Whales — wallet addresses with extremely large holdings of tokens — have continued to accumulate. The percentage of Bitcoin held by whale addresses has risen to its high of 80.5%, which signals a possible supply crunch and that the market has shifted to long-term holders.

In traditional finance, Fidelity caught attention for publishing a report that predicted a $1 billion Bitcoin price by 2038. This is certainly headline-grabbing, and includes inflationary principles to account for the steep rise. Fidelity Digital Assets surveyed institutional investors and found that 70% of institutional investors have or intend to buy cryptocurrencies in the near future.

Asset-Specific News

Ethereum saw the implementation of the much-anticipated EIP-1559 upgrade, which simplified the fees for transactions. Among other changes, some of the fee is now burned, or destroyed, to create a deflationary element to the token.

NFT's saw a 10x increase in transaction volume in August compared to July, crossing $3.4 billion. Visa bought a piece from the most popular collection of NFT's, called CryptoPunks.

FirstWatch's Digital Asset Reviews on Cardano and Compound proved timely. The Charles Hoskinson-backed Cardano started the quarter valued at $1.40 and finished at $2.25 after peaking at nearly $3.00. Cardano's roadmap included smart-contract capabilities, which were successfully put in place with an update on September 14.

In more token-specific news, Solana (SOL) has seen explosive growth as the network has seen further adoption and stress tests. This quarter, the token rose from $32 to a high of over $200. On January 1, 2021 the coin was priced at $1.60.

Bitcoin Performance Comparison: July 1 through September 30

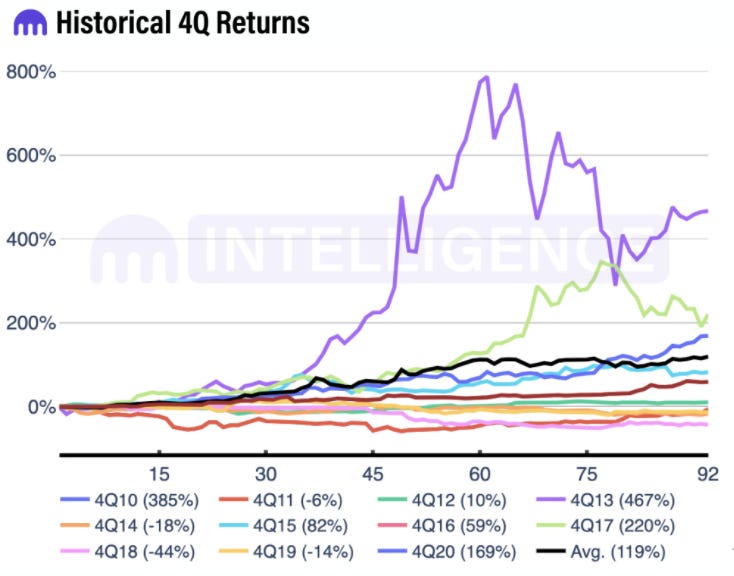

And to give a preview as we head into the last quarter of the year...The average Q4 return since Bitcoin's inception has been 119%.

Stats & Takeaways:

The quarterly range for Bitcoin is between $35,000 and $54,000.

The Bitcoin Fear and Greed Index started and ended the quarter with Fear, with significant greed mid-quarter in late August.

NFT sales volume was $10.7 billion, up eightfold from Q2.

Bitcoin is up 46% YTD.

Bitcoin historically has returned 119% average since 2010

➡️ About FirstWatch Crypto ⬅️

FirstWatch Crypto was started by Dan McGlinn (@DigitalDanMcG)and John "Blaize" Hrabrick (@blaizebitcoin) who have been investing in the space for a combined 8 years. FirstWatch Crypto is on a mission to simplify the crypto investment landscape.