What is a Non-Fungible Token (NFT)?

Subscribe below to learn more about Crypto every week.

An NFT, or non-fungible token is a unique, digital, tradable asset on the blockchain. This could come in the form of an image, a music file, or a video game character. They are built on smart contract-compatible blockchains like Ethereum, which currently has the majority share of NFT usage right now.

To be able to talk conversationally about NFT's here are two concepts you need to understand:

Fungibility

Fungible means interchangeable. One dollar is exchangeable to another dollar and you can exchange them without any meaningful difference. Similarly in crypto-land, one Bitcoin is equivalent to another. Non-fungibility simply means a unique item.

Proof-of-Ownership

The blockchain is the best technological system that exists to prove ownership. Every owner of every asset is recorded and easily looked up via the blockchain ledger.

When you combine these two concepts, you can create NFTs. An NFT is simply a unique asset in real life (a house, a car, a painting) that exists on the blockchain. This is a huge evolution in tech's capabilities.

Anything digital, which used to be infinitely repeatable using everyone's favorite commands like copy-and-paste, can now be unique.

A giant ecosystem has arisen in the past year that has built out use cases for this technology. Some of the earliest adopters of this tech have been targeting collectors in the art and sports worlds. Artists and organizations like the NBA have been selling "moments" as collectibles. Trading card companies are digitizing their cards. Artists have switched over to releasing their art on the more liquid blockchain.

The video game industry is rapidly adapting. Unique outfits and weapons in video games that cannot be replicated can be bought and sold. Rarely have we seen a frenzy like this for adoption of new technology so quickly. History may view NFTs as the killer app for the blockchain to onboard the average user around the globe.

The market of non-fungible tokens (NFT) exploded at the beginning of 2021. A couple quick facts from our friends at Hackernoon:

The total NFT market cap reached $27.9 billion in early 2021, amounting to 10% of global art market sales.

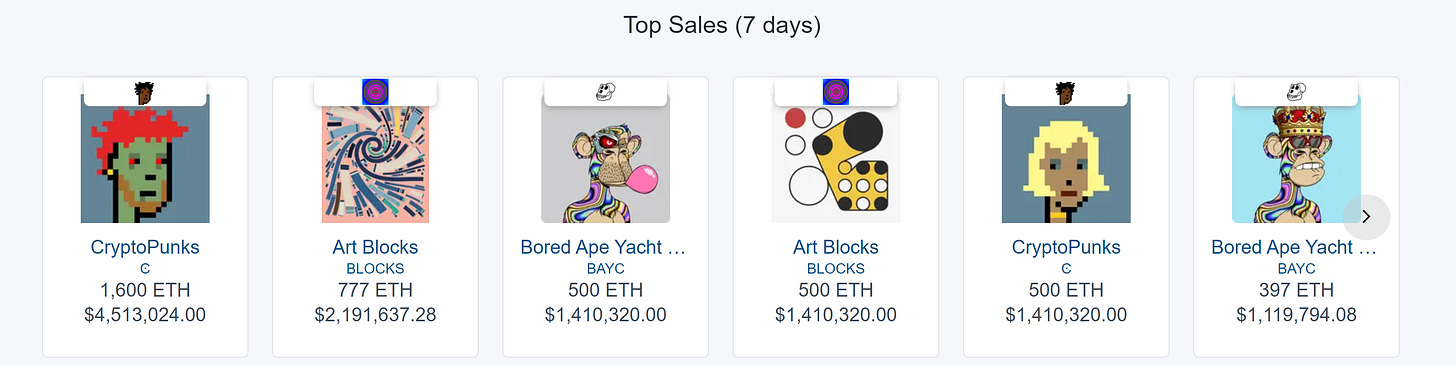

The largest percentage of NFT sales comes from collectibles and art like Cryptopunk, Hashmasks, Beeple.

Sport is the second-largest category. Some of the popular projects are NBA Top Shot and Topps MLB.

A big portion of sales pertains to NFT games like Axie Infinity, games built on Enjin and Ultra platforms.

Metaverse sales account for 8% of overall NFT sales. A metaverse is an alternative digital reality where people can play, work, and buy goods.

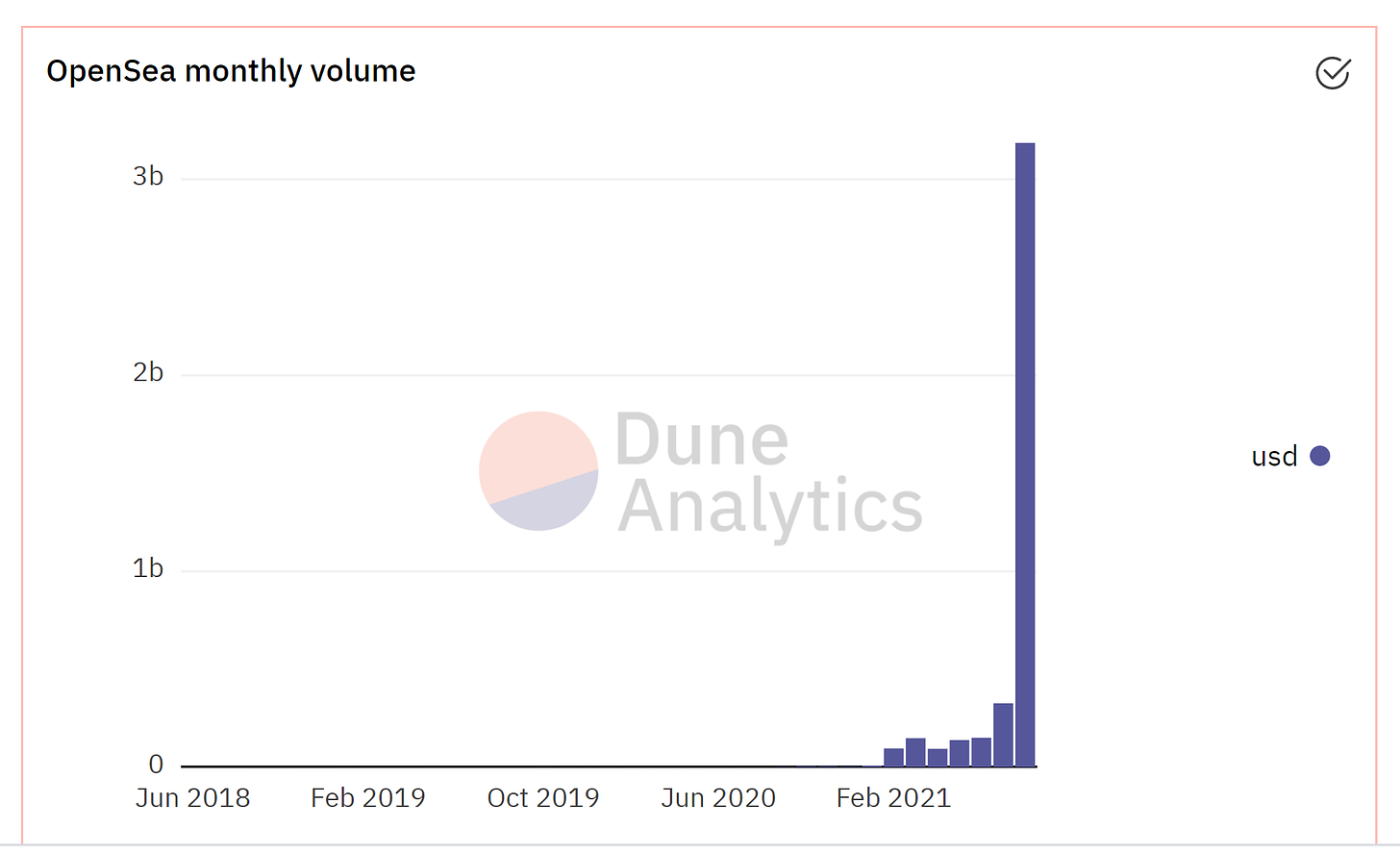

OpenSea is the leading NFT exchange. The total volume traded on OpenSea in August was $3.16 billion.

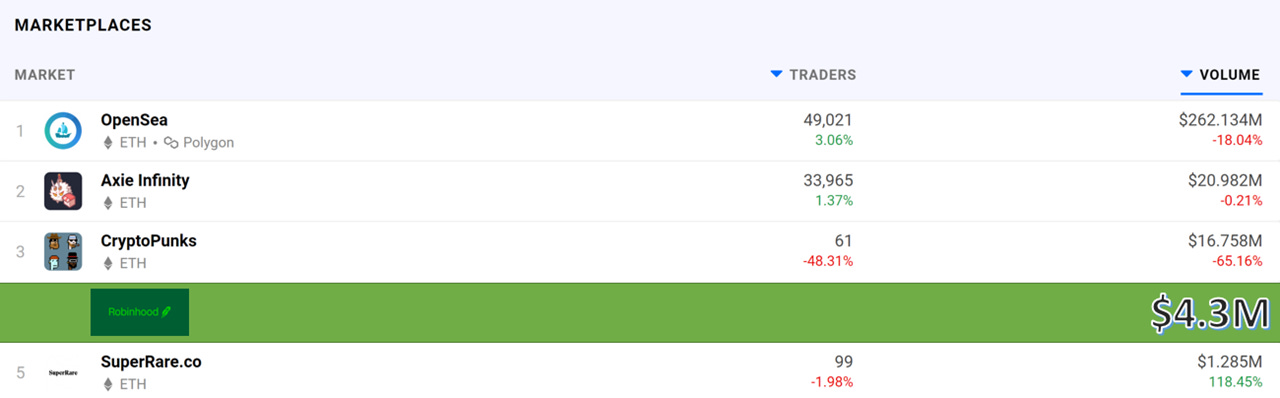

OpenSea is dominating the market. They currently boast a daily trading volume of $262 million. Compare that to well-known trading app Robinhood, which had $4.3 million of daily trading volume in June. OpenSea had about 61x more daily volume. This also shows just how big of a market NFTs can be, content up until this point had limited monetization strategies, NFTs change things.

Below are the biggest "NFT Marketplaces". You can think of these as platforms to create, buy and sell NFTs. You can see Robinhood's daily trading volume on the chart below to compare how much money has flowed into NFTs recently.

These numbers are staggering. OpenSea passed Uniswap, the leading Ethereum decentralized exchange, for the first time in network usage. There is no comparison to what is happening currently in tech or finance.

Visa, one of the world's largest payment companies, just bought a "CryptoPunk," one of the original NFTs on the Ethereum blockchain, for $150,000. Big name entrepreneurs like Mark Cuban and Gary Vaynerchuck have launched NFT platforms. Patrick Mahomes has his own NFT collection. Odell Beckham Jr. just bought a Cryptopunk, so did Jay-Z. Andreessen Horowitz just led a $100 million funding round for OpenSea. The list goes on and on and on...

Key Takeaways?

FirstWatch Crypto believes that NFTs are transformative technology. Where the tech is going is still not fully understood by anyone, but it will be integrated into our world alongside cryptocurrencies.

NFTs might turn out to be like crypto for brands. The marketing industry could be rebuilt on NFTs and the blockchain. We have spent a lot of time in the blockchain space and know that these trends come in waves. The NFT craze, especially this month, has been unlike anything seen yet in crypto, and we expect it to cool down after the mania wears off. Yet, the tech has signaled that it is here to stay and has the factors of appealing to non-technical people that cryptocurrencies don't have. A couple big takeaways:

Just like every company in the future will need a crypto strategy, it's possible they will also need an NFT strategy as well.

The three main industries gaining traction with NFTs are (1) Art, (2) Sports Marketing, (3) E-sports/Gaming.

Celebrity adoption has accelerated the space rapidly.

NFTs run on smart contract blockchain platforms. Ethereum is currently the main player for NFTs, but look out for Tezos, Solana, Cardano, or Binance to take some of that market share in the future.

Some key stats:

In the past 30 days about, $4.75 billion in value changed hands via NFT trading.

OpenSea has done $3.16 billion in volume in August. The daily average trading volume is currently 61x greater than the last stat Robinhood posted.

NFTs have passed DeFi as the biggest user of "gas fees" on the Ethereum network.

The total NFT market cap has reached $27.9 billion. This would put "NFTs" in the top 10 largest cryptocurrencies by market cap.

OpenSea raised $100 million from Andreessen Horowitz.

Resources:

The Opensea NFT Bible

A 12-Year-Old Made Almost $400,000 Minting NFTs of Whales on His Summer Vacation

A Cryptopunk sold this week for 1600 eth, roughly $4.5M

➡️ About FirstWatch Crypto ⬅️

FirstWatch Crypto was started by Dan McGlinn (@DigitalDanMcG)and John "Blaize" Hrabrick (@blaizebitcoin) who have been investing in the space for a combined 8 years. FirstWatch Crypto is on a mission to simplify the crypto investment landscape.

Disclaimer: None of the above is investment advice. This blog is published for entertainment and informational purposes only. The ideas expressed are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. Nothing on this blog constitutes investment advice, performance data, or any recommendation that any security, portfolio of securities, investment product, transaction, or investment strategy is suitable for any specific person. You should not use this blog to make financial decisions. We highly recommended you seek professional advice from someone who is authorized to provide investment advice. You should always do your own research before investing in cryptocurrencies. It is a volatile market.