The Current State of Bitcoin

An Update on the Original Blockchain

The price action of and market sentiment around bitcoin have investors and speculators alike wondering about bitcoin’s future.

But what is going on fundamentally with bitcoin, both on-chain and in communities and businesses worldwide? Does it confirm what we see in the reflecting price of the asset?

Here’s a dive into a few ongoing themes to truly discover the current state of bitcoin.

Bitcoin Lightning Network Statistics

Bitcoin has a second-layer payment protocol built on top of it called the Lightning Network. This network allows for near-instantaneous, permission-less payments to occur on top of bitcoin’s underlying decentralized settlement layer.

The idea is that with the development of the Lightning Network over time, bitcoin — a global store of value — can also become a medium of exchange and eventually a unit of account. The evolution fulfills the three functions of money. So, what does the growth of this additional layer built on Bitcoin look like now?

Despite the depressed prices in crypto this year, the development and growth of the Lightning Network continue to reach new all-highs. Holdings of bitcoin on the lightning network surpassed 5,000 BTC capacity for the first time.

Consider scale. Global macro investor Lyn Alden calls attention to a key point that the number of nodes seen on the Lightning Network could be misleading, as a single node could actually represent thousands of nodes via an exchange or custodian with many users.

Additionally, Lyn believes that the upside growth potential of Lightning could be massive. Lyn states in her article published in August that “the Lightning Network, if it gets to the size of having millions of open channels in the future, can theoretically handle an almost unlimited number of peer-to-peer transactions per second.”

While the future growth opportunity of LN remains, Lyn goes on to explain:

“In its current form there is an upper limit of tens of millions of new channels that could be opened per year (depending on what percentage of base layer transactions are channel-openings). Future developments could allow more participants to share a channel, and thus could substantially raise the effective scaling ceiling.”

Others in the space, including Eric Wall (previously CIO of Arcane Assets) and Rene Pickhardt (a Lightning Network developer), have expressed a more disheartened outlook on Lightning Network's potential in its current state. They reference the difficulties around reliability and the importance of UX. The ideology behind the payments network will only carry it so far.

Time will tell whether the network gains adoption, but we believe there are significant headwinds as bitcoin competes with Ethereum and altcoin news stories. Time favors bitcoin, the first cryptocurrency, but the network will need to make several fundamental changes to rebrand and reach a wider audience.

Bitcoin Treasuries Update

With bitcoin’s recent and prolonged price decline, many companies with bitcoin on their balance sheets have seen the investment turn negative. Perhaps one of the most well-known companies holding bitcoin is MicroStrategy, previously led by Michael Saylor, who recently stepped down to executive chairman after being CEO for 33 years.

As seen in the visual above, MicroStrategy has felt the true pains of being a bitcoin investor. Michael Saylor continues to be an evangelist though, sharing unrestrained optimism and outlook for the asset. He also points out that MicroStrategy’s stock has appreciated compared to other investment vehicles since the company purchased its bitcoin.

Another company that has largely been known to hold bitcoin, Tesla, recently sold about 75% of its original 43,200 BTC holdings in Q2 2022. Due to accounting practices for “indefinite-loved intangible assets,” (Blockworks) the company realized a loss on its balance sheet. Despite the sale, Elon Musk stated in a Q2 earnings call that Tesla is still open to purchasing bitcoin in the future.

Tesla is still second to MicroStrategy in terms of the sheer amount of bitcoin held by a publicly traded company. There are compelling technical reasons for companies to acquire bitcoin at these prices if they have the minimum four-year time horizon for which Saylor advocates. Will Clemente proposes one below.

Bitcoin Mining Updates

Mining profitability also fell drastically as of late, as the underlying asset’s price is a determining factor involved.

Bitcoin’s Proof of Work consensus mechanism also directly correlates to the energy expenditure utilized to maintain the security and integrity of its network. Needless to say, Bitcoin’s current hashrate is roughly 280 exahash (EH) per second at the start of October, a new all-time high, up about 300% from the infamous hashrate low caused by the China mining ban in July 2021. The implication here is that since that time, miners have been steadily coming back online to Bitcoin’s network and the network is more secure than ever.

Additionally, Bitcoin’s difficulty adjustment has also seen a steady rise since its July 2021 low. Bitcoin difficulty is best described as the relative measure of the number of resources required to mine bitcoin, and it is adjusted about every 2 weeks. As difficulty rises, profits fall. Difficulty is currently at 31.36 Terahash (TH). According to an article written by bitcoin.com, up-to-date metrics indicate that with “current BTC prices and electrical costs at $0.12 per kWh, nine ASIC bitcoin miners make an estimated profit between $0.33 and $4.24 per day.”

It has become increasingly harder to mine bitcoin.

Moreover, according to a recent monthly report by ARK Invest, it seems that miners are no longer in capitulation. The mining industry is exiting a major compression period in which mining companies cut back on production after experiencing losses, and we could perhaps see some better days ahead.

It is important to note that Bitcoin mining is a lucrative, but capital-intensive business. Much set-up/machine maintenance is usually required. Profitability is based on numerous factors that are subject to frequent change such as bitcoin’s current asset price, difficulty, hashrate, mining subsidy, and all costs/mining pool fees associated with certain methods. Sometimes it is better to simply buy and hold the asset long-term, especially with the bitcoin price down 70% from all-time highs.

What is going on in El Salvador?

Roughly a year ago, El Salvador (led by President Nayib Bukele) took a giant leap of faith to become the first country to adopt bitcoin as legal tender, which enabled the asset to be used to purchase most goods and services. However, as the crypto market has fallen this year, so has President Bukele’s popularity. Based on a recent article, the country’s former central bank chief stated that “No one really talks about bitcoin here anymore. It’s kind of been forgotten.”

The value of El Salvador’s $100 million+ investment in bitcoin has fallen by more than half. To make matters worse, the depreciating investment is coupled with the nation’s already climbing debt crisis. El Salvador recently requested for a $1.3 billion loan from the International Monetary Fund (IMF), but the IMF pushed back with an urgent call for the country to rethink its crypto investment. President Bukele publicly rejected that request and is still adamant about the prosperous futures of the digital asset and of the country.

Additionally, El Salvador’s plan for ‘Bitcoin City’, a tax-free haven where all businesses would support the asset, has been put on hold. El Salvador has technically not ‘lost’ any of its investment in bitcoin, as President Nayib Bukele has explained that the country has not sold and does not plan to anytime soon. Bukele is living out the age-old investment rule of, “it isn’t a loss until you sell”, further conveying his steadfast confidence toward a bitcoin standard.

In a recent article from Reuters, the National Bureau of Economic Research (NBER) found that only about 20% of Salvadorans who downloaded the Chivo app (the app used to onboard the country, offering new users $30 of bitcoin per person) continued to use the app after spending the $30 gifted credit. “Despite Salvadoran law requiring all companies to accept cryptocurrency, only 20% do so” according to a survey study.

El Salvador’s adoption of bitcoin as legal tender seems to be a failure from an outsider’s perspective, as many Salvadorans share the common opinion that it doesn’t benefit their country at all. Is this the underlying truth behind a nation’s negligence, or does more time have to pass to reap the rewards of adopting such a nascent and volatile asset class? The world may just stand by and wait to see.

Regulation Update

In the United States, crypto regulation is on the way. With upcoming midterm elections, it is unlikely there will be any bills of major significance passed before the end of the year, although the OECD and other international bodies will release crypto frameworks.

There have been governmental measures taken to begin to address the new ‘Wild West’ of finance. In a letter published in September 2022 by Kiplinger, it was stated that “the most basic challenge regulators face [is] deciding what exactly cryptocurrencies are.” Are they commodities or should they be treated as securities? The Securities and Exchange Committee (SEC) recently explained that some crypto assets would be scrutinized as commodities and some as securities. Bitcoin, for example, was deemed a commodity that would be regulated under the Commodity Futures Trading Committee (CFTC).

Many supporters of bitcoin in the United States are pushing for the asset to be permanently deemed as a commodity, as that committee is generally viewed to be less harsh. But for many others who invest in any of the thousands of other existing cryptocurrencies, there is still a gray area of regulatory concern. Needless to say, the regulation by enforcement by the SEC has created hesitancy among institutions.

For now, one regulatory step was the recent executive order from President Biden, who urged the SEC, CFTC, IRS, etc. to develop regulatory clarity that protects the American financial system and its consumers. Many in the Bitcoin and crypto space have also stood forth to educate politicians and legislators alike, as they are aware of the critical role that regulation will play.

Bitcoin Maximalism

We believe bitcoin has reached an inflection point. As a store of value, bitcoin remains front and center, but the technological development and experimentation outside of bitcoin have largely dominated the recent headlines. With the recent successful ETH merge that took place on September 15th, we thought it would be interesting to revisit an old post uploaded by Vitalik Buterin titled, “In Defense of Bitcoin Maximalism”.

The article covers an in-depth reflection on the importance and global influence of fast-rising blockchain technologies. It stresses the cultural and structural advantages that make crypto assets worth holding over the long term. Bitcoin maximalism “is not just Bitcoin-for-the-sake-of-Bitcoin; rather, it’s a very genuine realization that most other crypto-assets are scams, and a culture of intolerance is unavoidable and necessary to protect newbies and make sure at least one corner of that space continues to be a corner worth living in.”

As we have seen the fall of the global crypto market along with real political warfare and financial stress, Vitalik’s words echo in our minds. “We live in a dangerous world, where there are plenty of bad-faith actors who do not listen to compassion and reason,” which is applicable not only to bad actors in the crypto world (where there are many scammers and corrupt people simply trying to obtain more wealth at the center of crypto projects) but also to global powers.

The article is a reminder as to why bitcoin, with its fundamental simplicity and headstrong culture, will continue to be successful despite worldly pressures and alternative blockchains.

Vitalik explains that at their core, blockchain technologies are fundamentally created to protect people and help them thrive.

To be considered an ‘excellent’ blockchain, one must have a robust and defensible technology stack as well as a robust and defensible culture.

Bitcoin has both of these things.

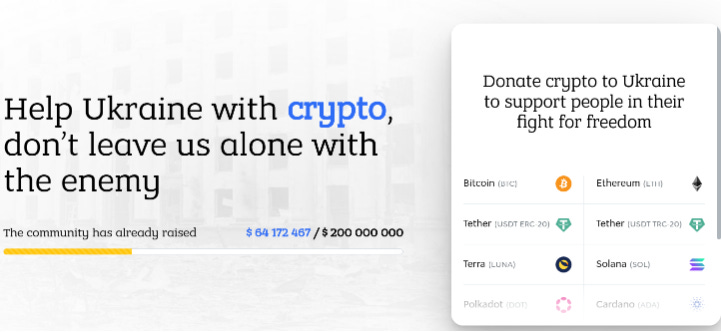

Judge a blockchain not by new applications and ecosystem growth, but by its fundamental use as a currency and you’ll have an idea of its future success, explains Vitalik. Currency is the most successful real-world use case and application of blockchain technologies, by far, as seen with practical cryptocurrency donations/aid to developing countries like Argentina, Ukraine, and Nigeria.

It’s easy to be critical of bitcoin. It sits 75% off its all-time high; new and exciting blockchains are being released or upgraded; key adoption narratives have slowed.

But we reference Vitalik’s post along with the other narratives above to remind ourselves that bitcoin serves a fundamental use case of blockchain and cryptocurrencies. Adoption and infrastructure continue to scale, and fundamental network metrics are growing despite the deflated prices.

Thanks for our contributor Justin Kim for helping with this week's newsletter.