“I’ve been doing these [monthly highlights] for 46 straight months and I’ve never seen one like this before.”

— Travis Kling on the news from the month of June

This is a packed update with significant events coming from all corners of crypto. If this is as far as you read, take these two notes with you:

The crypto ecosystem experienced extreme contagions this quarter that compounded selloffs of risk assets more broadly. These contagions caused the collapse of significant funds and projects, like Terra and Celsius, that have caused further domino effects to ripple through the system.

But regulation, funding, mining, and adoption announcements continue to point to growth. The asset class continues to build and experiment with new projects during the price drawdowns.

Crypto Market Performance

In May we shared thoughts on the state of the market. Plenty has happened since then and prices have remained as volatile as predicted while prices remain significantly below all-time highs.

The market contracted significantly as the Federal Reserve took a tough stance on inflation through its highest interest rate hike since 1994. Risk assets across the board were sold off. While correlations remain high between crypto assets and between bitcoin and the Nasdaq, crypto is behaving similar to other risk assets though more volatile.

The crypto market reeled from massive deleveraging and contagion’s specific to the crypto space (see below).

Bitcoin dropped nearly as much as the rest of the market. This can be attributed to the contagions described below as well as miner capitulation and macro fears. The two largest drops came after the collapse of Luna and the pause on Celsius withdrawals.

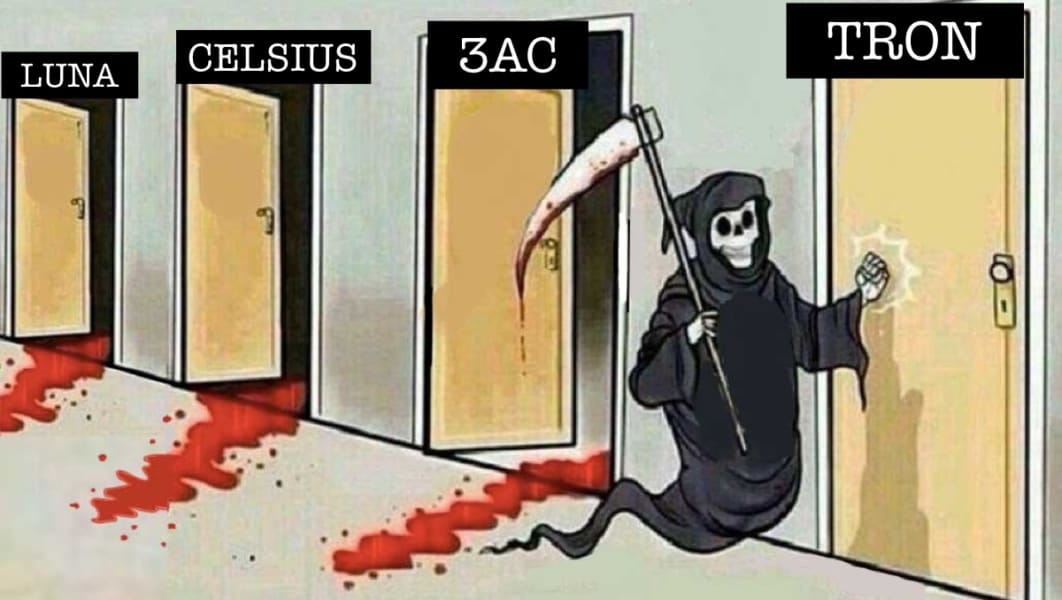

Contagion

This quarter saw the collapse of the Terra protocol and the subsequent unwinding of some of the biggest entities in crypto that were exposed to the leverage in the system. Poor risk management practices and overexposure are the primary culprits. We wait with bated breath if there is more to come among the affected entities counterparties.

Terra/Luna Collapses: Algorithmic Stablecoin Model Fails

Luna rose from $4 to $110+ in less than a year. In May, the LUNA token and its algorithmic “stablecoin” terraUSD collapsed, erasing nearly $60b in value. Read this or this to learn about the mechanics of the collapse. The Luna protocol lost all credibility, as did algorithmic stablecoins (for now). The collapse sent shockwaves throughout crypto.

3 Arrows Capital (3AC) is Liquidated

Due to its exposure to Luna and risky capital management, Three Arrows Capital, one of the largest crypto hedge funds, failed to meet margin calls mid-June and became a forced seller at a time of low liquidity. The firm partnered with a restructuring firm to manage the insolvency. The firm was also responsible for managing treasury assets of select investment companies. With ongoing liquidations, we could see further price crashes.

“Mashinsky’d” Becomes a Verb: Lender Celsius Gambled with Funds

Following the collapse of the Luna protocol, Celsius, a crypto asset lender, paused all withdrawals on June 12th with alleged solvency issues. Celsius’s business model is: deposit crypto and they will offer a yield. It turns out their yield was primarily being generated by Terra/Luna. About 1.7 million Celsius users were affected by the withdrawal pause. Celsius has since hired lawyers to restructure its liabilities. Poor risk management and overexposure are the culprits: Celsius promised returns as high as 19% annually, while investing investors’ funds into risky crypto DeFi products.

SBF Comes to the Rescue

Sam Bankman-Fried, CEO of FTX and founder of Alameda Research, offered lines of credit to distressed firms through his entities. Both BlockFi and Voyager were affected by the collapse of 3AC and Celsius. SBF provided a $485m loan from Alameda Research to digital asset exchange Voyager and a $250m line of credit from FTX to BlockFi. FTX is emerging as the big winner from this market crash.

Regulatory News

Bi-partisan Crypto Regulation

On June 7th “the most comprehensive piece of crypto legislation to date” was released in the Senate. The bill puts bitcoin under the control of the CFTC and outlines procedures for digital asset exchanges to register as financial services entities.

Gensler and Yellen Speak Up

Janet Yellen pointed to the Terra meltdown as demonstrating the risks surrounding crypto, saying to the House Financial Services Committee “I wouldn’t characterize it at this scale as a real threat to financial stability, but they’re growing very rapidly and they present the same kind of risks that we have known for centuries in connection with bank runs.” Gary Gensler also reaffirmed that bitcoin is a commodity, under the jurisdiction of the CFTC.

SEC Doubles Crypto Enforcement Unit

The Crypto Assets and Cyber Unit in the SEC is doubling in size to ensure investors are protected from everything the SEC views as unregistered securities. Something to keep an eye on.

Asset & Funding News

Here are a digestible handful of asset-specific announcements from the quarter.

Solana repeatedly made headlines this quarter. Network outages were a common issue, with multiple-hour outages. The protocol announced the Solana phone in a presentation eerily similar to an Apple announcement. The phone will be a high risk high reward play and something to keep an eye on.

The Ethereum merge is still on track for late summer. The latest merge test with the Ropsten network went smoothly, a big milestone on the way to the transition from Proof of Work to Proof of Stake. The transition will be one of the largest technological achievements since the dawn of crypto itself. Two more practice runs will occur in the coming months.

Circle, the company that issues the USDC stablecoin that is pegged to the value of $1, announced the launch of the Euro Coin (EUROC). The new coin will be fully backed by euros and launched on the ethereum blockchain. It will follow regulations of the EU and the US. This is great news for the stablecoin ecosystem.

After a frenzied Q1 funding landscape, this quarter has seen a general slowdown in the pace and size of investments in crypto. Global deal activity shrunk 23% between Q1 and Q2, after a first quarter that saw the most VC money everrecorded in a three-month period. .But there was still plenty of funding news.

Solana NFT marketplace Magic Eden raised $130m from Sequoia, Paradigm, and Lightspeed at a $1.6b valuation.

Dragonfly Capital raised a third digital asset VC fund, totaling $650m. The significance? Unnamed Ivy League university endowments were investors alongside KKR and Sequoia China.

The Near Protocol raised $350m in a round led by Tiger Global, more than double what it raised just three months prior. Near is a competing Layer 1 blockchain.

Chainalysis, a blockchain data firm, reached an $8.6b valuation after a $170m Series F funding round.

Framework Ventures raise $400 million in its third fund, bringing total AUM to $1.4 billion.

Financial Services Industry News

Grayscale sues the SEC! “Our application to convert GBTC to a spot ETF was denied by the SEC.” Grayscale is determined to get approval for a spot Bitcoin ETF, arguing a spot ETF should be approved if derivates ETFs have received approval. Part of the impetus for Grayscale: GBTC shares currently trade at a 30% discount to NAV.

Investment giant Fidelity announced that US customers investing in 401(k) retirement plans will be able to allocate those savings into bitcoin. With over 20,000 corporate clients, Fidelity has opened floodgates; head of retirement products David Gray said: “We view this as the beginning, not the end. We are preparing for the next generation of investors and what they might want from their retirement plan. Fidelity also plans to double the number of employees in their digital asset division this year.

Goldman Sachs is looking to raise $2b to buy Celsius’s distressed assets. They could purchase the assets at a significant discount if the insolvency sale comes to fruition.

JP Morgan says bitcoin is massively undervalued. The fair price valuation puts bitcoin at around $38,000. Due to the greater upside, digital assets are now the preferred alternative asset for the banking giant, replacing real estate.

This quarter was marked by hiring and firing across crypto, a reflection of how companies have managed spending over the last two years of growth. Coinbase cut its workforce by about 18%. Gemini slashes 10% of employees. And Brazilian company 2TM cut 12%. Conversely, some leading firms are stepping up hiring efforts. Binance is hiring for 2,000 positions after frugal spending recently, arguing that now is a great time to hire and acquire. Krakenannounced similar.

Global News

Germany goes crypto. In a report by Coincub, Germany unseated Singapore as the most crypto-friendly country. Among a host of metrics, Germany is the home of crypto exchange-traded products, and 16% of the population between 18 and 60 own crypto and intend to buy more.

Brazilians have access to bitcoin. The announcement from Nubank gives all 54 million customers of the Warren Buffet-backed bank access and education about the largest digital asset.

The Central African Republic declared bitcoin legal tender, the second nation to recognize the cryptocurrency as such.

a16z released their State of Crypto report, notably detailing the value that web3 applications deliver to creators.

Solana launched a $100m Korea-exclusive fund. The timing is notable as it comes after the collapse of South Korean-based Terra.

Mining

Fort Worth becomes first US city to mine bitcoin. Starting small, the city will operate three machines in the IT wing of the city hall building. The move will put bitcoin on the city’s balance sheet, and the city hopes the tech innovation will put the city on the map.

The energy is converging with bitcoin mining at a rapid pace. Exxon Mobile is running a pilot program using the excessive flared natural gas that would otherwise be released to the atmosphere. “With oil companies facing mounting pressure from governments and agencies to reduce their greenhouse gas (GHG) emissions, one could assume that it makes sense—both environmentally and economically—for an oil and gas producer to link up with a Bitcoin miner.”

➡️ About FirstWatch Crypto ⬅️

FirstWatch Crypto was started by Dan McGlinn (@DigitalDanMcG) and John "Blaize" Hrabrick (@blaizebitcoin) who have been investing in the space for a combined 8 years. FirstWatch Crypto is on a mission to simplify the crypto investment landscape.

Disclaimer: None of the above is investment advice. This blog is published for entertainment and informational purposes only. The ideas expressed are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. Nothing on this blog constitutes investment advice, performance data, or any recommendation that any security, portfolio of securities, investment product, transaction, or investment strategy is suitable for any specific person. You should not use this blog to make financial decisions. We highly recommended you seek professional advice from someone who is authorized to provide investment advice. You should always do your own research before investing in cryptocurrencies. It is a volatile market.