Remember when we said, Bye Bye Banks? Here's why...

How does a bank work? The bank loans your deposits out for more than it pays you to store them (current rates are effectively 0% nowadays).

How does Bitcoin work? A network of validators (miners) uses computers to validate transactions on a public accounting system (blockchain) and gets paid for doing so. This allows trusted peer-to-peer payments, because each miner can see that everyone else isn't cheating. This is called a proof of work blockchain.

Staking is a combination of these two concepts. Instead of using computers to validate transactions, you can deposit (stake) cryptocurrencies into a wallet that validates transactions. You get paid for doing this. This is called a proof of stake blockchain. There is a large push to move blockchains to proof of stake mining due to less environmental impact and so mining rewards become accessible to anyone holding crypto.

Liquidity mining is a similar concept to staking, but takes place in the world of DeFi. As we discussed, DeFi removes the middleman of traditional financial services like lending and exchange, allowing for the creation of a peer-to-peer network. Both lending and exchange require liquidity, for example, so in order to exchange one crypto into another, there must be pools of both currencies locked up in smart contracts. Decentralized exchanges need to incentivize user to lock up their coins on their contracts. To incentivize you to do this, they offer you a reward in the form of an APY yield to keep your coins locked up. This is liquidity mining.

How much can I earn for just holding my crypto?

What does this mean for you?

Staking and liquidity mining allow investors to earn passive income on crypto. For beginners, many of the main cryptocurrency exchanges will pay you up to 13% on certain cryptocurrencies if you stake on their platform. On the back end, just like a bank, these exchanges are making money by staking/lending your coins for slightly more money than they are paying you.

If you want to be your own bank and stake your own coins, hardware wallets like Ledger allow for staking in Cold Storage, and online "Hot Wallets" like Metamask allow you to access the largest DeFi applications.

The bottom line is this, you can make money just by holding cryptocurrencies, which we also expect to appreciate dramatically in value. The dividend-like returns are paid in cryptocurrencies, allowing you to capitalize on the token's growth as well by reinvesting the asset. These returns are almost without a doubt bigger than any banking interest bearing account. If you are going to invest in cryptocurrencies, this is something to capitalize on.

Where can I Stake?

Exchanges

Exchanges where you can store your crypto online in hot wallets are the most popular places to stake. These include Gemini, Blockfi, Coinbase, Kraken and Binance.

DeFi

Lend your crypto to someone else through a smart contract using Compound, Maker, Aave, or many more options.

Cold Wallets

Many cold/hardware wallets are allowing you to stake offline. This allows you to combine maximum security with earning passive crypto income. Ledger currently provides staking rewards for 7 different cryptocurrencies.

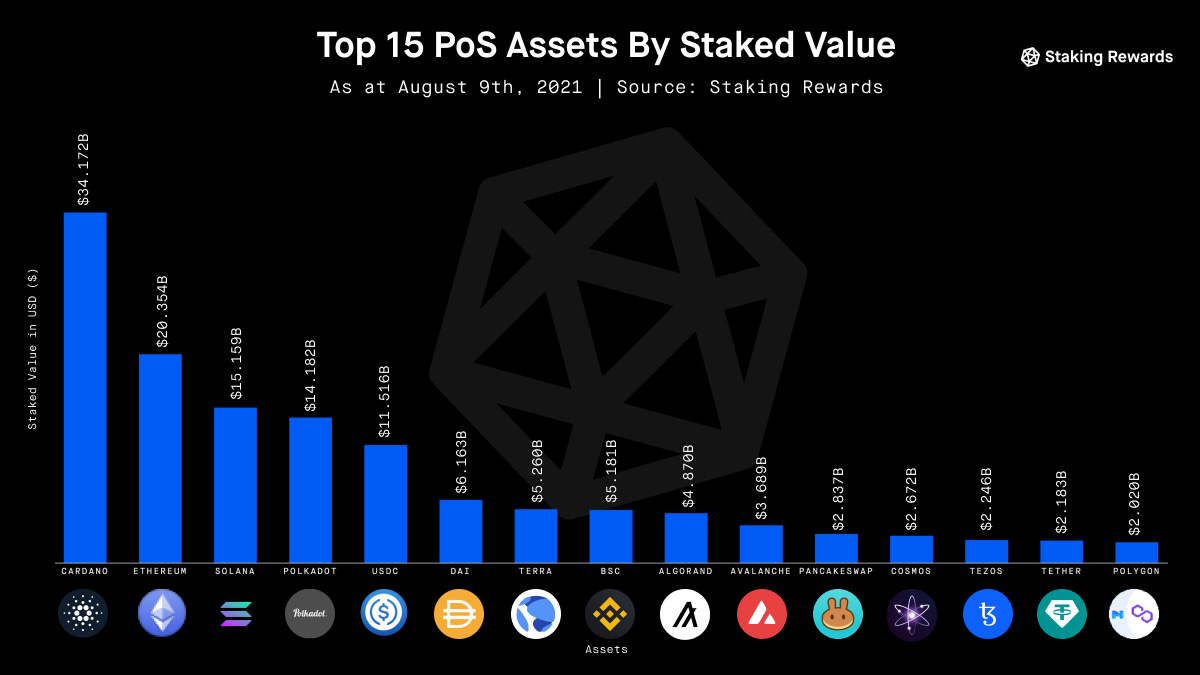

Some key stats:

Ethereum passed Bitcoin in trading volume in Q2 2021 for the first time ever. Coinbase attributes that partly to its Ethereum staking product.

Cardano, the biggest proof of stake only blockchain, has $46B (USD) currently being staked.

Ethereum is switching from proof of work to proof of stake. As of right now, 5% of total Ethereum supply is being staked, look for this number to rise.

Resources:

Check out this super handy staking rewards calculator.

Staking Yields on Gemini.

➡️ About FirstWatch Crypto ⬅️

FirstWatch Crypto was started by Dan McGlinn (@DigitalDanMcG)and John "Blaize" Hrabrick (@blaizebitcoin) who have been investing in the space for a combined 8 years. FirstWatch Crypto is on a mission to simplify the crypto investment landscape.

Disclaimer: None of the above is investment advice. This blog is published for entertainment and informational purposes only. The ideas expressed are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. Nothing on this blog constitutes investment advice, performance data, or any recommendation that any security, portfolio of securities, investment product, transaction, or investment strategy is suitable for any specific person. You should not use this blog to make financial decisions. We highly recommended you seek professional advice from someone who is authorized to provide investment advice. You should always do your own research before investing in cryptocurrencies. It is a volatile market.