What is Algorand?

Algorand, traded under the ticker $ALGO, is a Layer 1 blockchain that is a base layer for decentralized applications (dapps), with a particular focus on permissionless payments. Algorand is able to use a Proof of Stake (POS) network to process 1,000 transactions per second, with each transaction taking about 5 seconds.

Labeled as “the world's most decentralized, scalable, and secure blockchain infrastructure” Algorand aims to find its own balance between security, decentralization, and scalability. Algorand has already seen mass adoption worldwide, with over 26 million current addresses compared to ETH, the blockchain leader at over 166 million. Their combination of security, scalability, and low fees has caught the eye of many blockchain developers. Let’s see what else Algorand offers.

Algorand’s Modern Blockchain

The world continues to become more aware of our carbon footprint, especially in regards to blockchain energy consumption. Algorand acknowledges these ESG issues and has pledged to become the greenest blockchain, with the goal of eventually having a carbon-negative footprint.

In an interview with CNBC, Algorand founder Silvio Micali stated, “Algorand developed a public blockchain that runs on a version of proof-of-stake, which drives electricity consumption to almost zero…on a fundamental level.” Pictured below is a graph from Algorand’s website showing Algorand’s per-transactions energy use as fractions of the energy use of Bitcoin and Ethereum. Algorand is the first carbon-negative chain, in which smart contracts automatically purchase offsets in response to the amount of carbon being consumed.

It is worth noting, that as the date of the Ethereum merge gets closer - estimated mid September- the gap between energy usage will narrow considerably and Algorand will lose this branding advantage.

The Team

All strong blockchains and companies tend to have one thing in common: a solid team. Algorand’s founder Silvio Micali is one of the most well-known and distinguished computer scientists in the world. Hailing from Italy, Micali received a PhD at Berkeley before becoming a professor at MIT. Micali is also a recipient of the Turing Award, often called the “Nobel Peace Prize of Computing.” In 2018, Micali added tech entrepreneur Steve Kokinos, the founder of Fuze, a cloud communications platform with a valuation of over $1.4B. Together Micali and Kokinos are co-inventors of zero-knowledge proofs.

Scalability, Security, and Decentralization

The three important factors to consider when assessing a Layer 1 blockchain are scalability, security, and decentralization. These factors make us the “blockchain trilemma.”

For Layer 1 protocols, the solution to the trilemma determines the future use cases of a protocol. Algorand has been able to have all three function at a high level on its mission to deliver permissionless payments. Typically, security and scalability are at odds with each other in decentralized computing. Algorand attempts to solve this problem by randomly selecting a few validators to perform the work, instead of all of them. Algorand emphasizes that they are a pure POS mechanism, rather than a delegated mechanism used by Cardano, EOS, and TRON (see resources for more about the difference).

Micali developed pure POS by using a truly random algorithm that selects validators randomly from all token holders, inspiring the name Algo(Algorithm) Rand(Random). This consensus mechanism creates a lottery of sorts to select a staker to validate a single transaction while making it impossible to predict who the next validators will be. This ensures that Algorand is not simply selecting the majority holders to validate, which can mislead investors. Giving all token holders an equal opportunity is something Micali stresses, as he wants no single person to have an advantage, including Algorand employees and owners.

The Algorand ecosystem and total wallet addresses show that the protocol is seeing adoption.

Algorand Criticisms

“If it’s so great, why hasn’t everyone turned to it yet?” As with any digital asset, it’s important to consider the drawbacks.

One of the biggest factors in this is that Algorand is running their own chain computing mechanism. If you refer to the Avalanche analysis, or our analysis on a Multichain future many prevalant chains piggyback on using the Ethereum Virtual Machine (EVM). Algorand only runs off their own virtual machine, and currently is not compatible with EVM. Considering ETH is one of the biggest chains in the world, incompatibility requires a bigger barrier to entry because developers need to learn a new toolkit.

To solve the compatibility issues, Algorand created a $10m grant fund to “explore and accelerate the technical work needed to deliver EVM compatibility.” This falls in line with our thesis that EVM chains and Solana are leading the L1 race.

Look at the Algorand ecosystem, and only a few projects are recognizable or well-proven to the crypto-savvy. Why aren’t more developers building on Algorand? There is constant platform competition in the crypto market. To stand out to developers, Algorand needs something more than a goal of being the greenest blockchain.

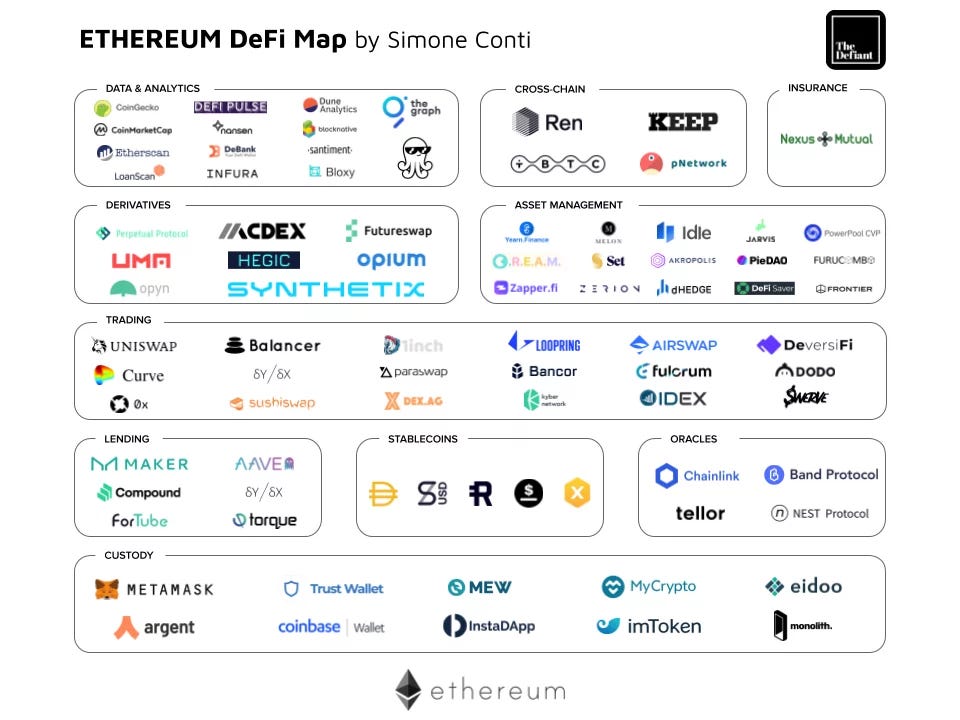

Two of the protocol’s top six projects are projects that Algorand built itself, with AlgoFund being the top project on the entire chain. Compare that to Ethereum, which has recognizable projects like Aave, Uniswap, Maker, Cryptopunks, and on ramps such as Opensea and Metamask. EVM compatibility will be very important for the long term success of Algorand.

Developers play a major role in the system, but funding from VC’s and public token sales play a role, too. Algorand currently has 70% of their coins in circulation, sitting at a market cap of just over $2.2bn.

With 30% of the total supply not yet in circulation, how strong will adoption need to be to hold the price stable, especially when Algorand’s circulating supply is in line with dominant competitor Solana and compares less favorably to key L1 competitors like NEAR. This dilutive effect may cause public investors to stay away from Algorand, because beyond the current state of the market, the current inflation rate and low transaction volume could continue to hurt Algorand’s token price.

The Future of Algorand

During the early years, the development of Algorand caught the eye of big investors, and the protocol has even been labeled by advocates as the future of finance. Anthony Scaramucci, the founder and chairman of hedge fund SkyBridge Capital, announced the firm raised a $250M Algorand fund and has around $4M of ALGO tokens on its balance sheet. Scaramucci remains an outspoken proponent of the protocol, calling it “the next Google” as a leader among competing Layer 1’s, and of crypto in general. Half of the firm’s $3.5B of assets are in bitcoin, Ethereum, and crypto-related stocks.

Algorand also landed a partnership recently with FIFA to become the soccer league’s official blockchain partner. This is a big step for Algorand, considering FIFA is the largest and most profitable sports association in the world. Micali has stated that in the future he wants to develop Algorand into the preferred transaction chain in the world of business.

It’s quite a long way to go for Algorand, but Micali and his team already have big plans to speed up transaction time, as well as increase block size. They need to build out the Algorand ecosystem by strategically targeting developers who want to build on a unique chain. Time will tell, but fierce supporters continue to support the project in the face of strong competition due to its technical properties and value proposition in transaction settlement.

Algorand Statistics

ALGO token market cap sits at $2.2bn, which is the 28th largest

ALGO currently has 6.97bn tokens in circulation, which is 70% of their total supply

Sources

Algorand 101: more protocol information

Forbes interview with Silvio Micali

Algorand Whitepaper

Understanding blockchain scalability

Coinmarketcap’s Algorand page

Proof of Stake: Traditional versus Delegated

Scaramucci Bets on Algorand

Avalanche Digital Asset Review was published in collaboration with Carter Valerio.

➡️ About FirstWatch Crypto ⬅️

FirstWatch Crypto was started by Dan McGlinn (@DigitalDanMcG) and John "Blaize" Hrabrick (@blaizebitcoin) who have been investing in the space for a combined 8 years. FirstWatch Crypto is on a mission to simplify the crypto investment landscape.

Disclaimer: None of the above is investment advice. This blog is published for entertainment and informational purposes only. The ideas expressed are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. Nothing on this blog constitutes investment advice, performance data, or any recommendation that any security, portfolio of securities, investment product, transaction, or investment strategy is suitable for any specific person. You should not use this blog to make financial decisions. We highly recommended you seek professional advice from someone who is authorized to provide investment advice. You should always do your own research before investing in cryptocurrencies. It is a volatile market.